Chime is the banking app that has your again. Preserve your cash secure with protection functions, overdraft as much as $2 hundred* fee-unfastened, and receives a commission up to two days early with direct deposit^, with out a hidden costs‡.

Chime is the banking app that has your again. Preserve your cash secure with protection functions, overdraft as much as $2 hundred* fee-unfastened, and receives a commission up to two days early with direct deposit^, with out a hidden costs‡.

chime is a financial generation organisation, no longer a bank. Banking services furnished by using the bancorp bank or stride financial institution, n. A.; contributors fdic

relied on through hundreds of thousands

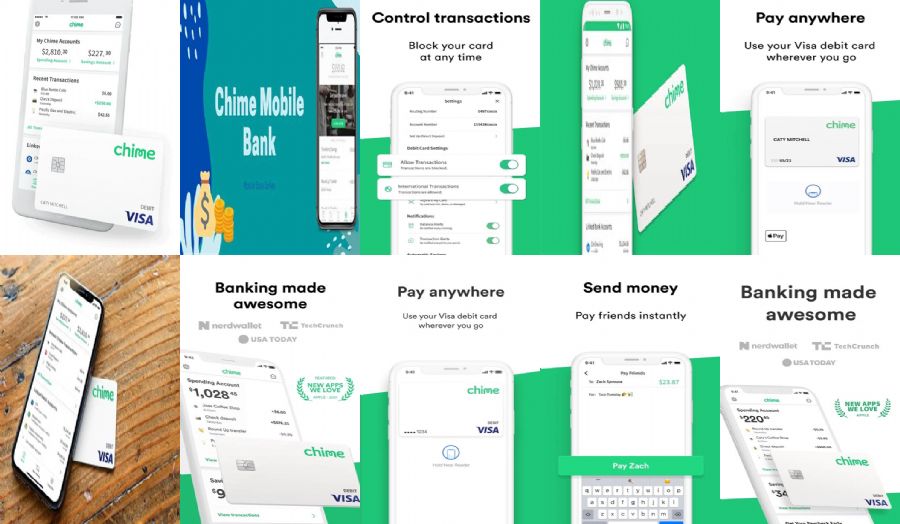

live in control of your money with -element authentication, touchid, or faceid. Permit immediately transaction alerts and every day balance updates, and block your card in a single faucet.

overdraft as much as $2 hundred*

we get it– while your balance is going for walks low, the remaining aspect you want is a $32 overdraft price. Eligible participants on chime can overdraft as much as $two hundred* on debit card purchases with no prices.

say goodbye to month-to-month charges‡

chime has no monthly protection expenses, minimum stability costs, or overseas transaction costs. Plus, get entry to 60k price-unfastened atms at locations like walgreens, 7-eleven, cvs, and greater.

receives a commission up to 2 days early^

get your paycheck up to two days early^ with direct deposit, in advance than you will with some conventional banks.

meet credit score builder, a brand new way to construct credit score

whether or not it’s for gas or groceries, use credit builder¹ to help boom your credit score score by using a mean of 30 factors² with ordinary on-time payments.

no interest, no annual prices, no credit take a look at to apply.

reach your money desires

shop money without even thinking about it. Automatic financial savings capabilities help you keep cash any time you spend or receives a commission.

pay pals and not using a transfer costs

ship cash to pals, own family, or roommates as fast as a text – with no transfer fees.

–––––

banking offerings for the chime spending account are provided by means of the bancorp bank or stride bank, n. A., participants fdic. The chime visa® debit card is issued by way of the bancorp financial institution or stride financial institution pursuant to a license from visa usaa. Inc. The chime visa® credit score builder card is issued via stride financial institution pursuant to a license from visa u. S. A. Inc. Debit card and credit score card can be used everywhere visa credit score playing cards are popular.

*chime spotme is an non-compulsory, no charge service that calls for $500 in qualifying direct deposits to the chime spending account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but can be later eligible for a higher restrict of up to $2 hundred or more primarily based on individuals chime account history, direct deposit frequency and amount, spending activity and different threat-primarily based factors. Your restriction may be exhibited to you within the chime cellular app. You’ll acquire word of any adjustments on your limit. Your restrict may additionally trade at any time, at chimes discretion. Spotme wont cowl non-debit card purchases, which include atm withdrawals, ach transfers, pay buddies transfers, or chime checkbook transactions. See terms and conditions.

‡out-of-network atm withdrawal expenses observe besides at moneypass® atms in 7-eleven, inc. Places and any allpoint or visa plus alliance atms. Different costs inclusive of 1/3-birthday party and cash deposit prices might also practice.

^early get admission to to direct deposit finances depends on the timing of the submission of the price document from the payer. We normally make those price range available on the day the price document is acquired, which can be up to two days earlier than the scheduled charge date.

¹to be eligible to use for credit builder, you need to have obtained a qualifying direct deposit of $200 or greater for your spending account inside twelve months of your credit builder application. See chime. Com/credit score-builder for detail on qualifying direct deposit.

²primarily based on a consultant observe carried out by transunion®, contributors who began using chime credit score builder in september 2019 found a mean credit score (vantagescore 3. 0) growth of 30 factors with the aid of january 2020. On-time charge history may have a high quality impact to your credit score rating. Overdue charge may negatively impact your credit score rating.